[ad_1]

Posted on February twenty fourth, 2021

It’s not on daily basis you come throughout a large-scale impartial mortgage lender that has been round because the Eighties, however Amerifirst Monetary Inc. suits that description.

The Arizona-based firm understands that there’s extra to the mortgage enterprise than simply refinances, which is why their aim is to be the lender of selection for actual property professionals in all of the markets they serve.

This might be a fairly sensible technique if and when rates of interest rise and the pool of eligible refinance candidates begins to run dry.

For those who’re thinking about buying a home, Amerifirst might be good selection on your financing wants since they’re closely centered on buy loans. Let’s uncover extra about them.

Amerifirst Monetary Quick Details

- Direct-to-consumer retail mortgage lender

- Based in 1989, headquartered Mesa, Arizona

- Provides residence buy financing and mortgage refinances

- Funded greater than $2 billion in residence loans final yr

- Most energetic in Arizona, Colorado, and California

- Licensed to do enterprise in 43 states and the District of Columbia

- Additionally function a number of DBAs together with AFI Mortgage, Spire Monetary, and Really Mortgage

Amerifirst Monetary Inc. is a direct-to-consumer retail mortgage lender, which means they function a name middle together with branches all through the nation.

The corporate was based all the way in which again in 1989 and is headquartered in Mesa, Arizona, which is simply east of Phoenix.

In addition they have branches in 9 states, together with Arizona, California, Colorado, Florida, Mississippi, Nevada, Oregon, Texas, and Utah.

Amerifirst seems to concentrate on residence buy financing, with roughly two-thirds of complete quantity devoted to residence consumers.

The remainder will be attributed to mortgage refinances, together with fee and time period refinances and money out refinances.

Final yr, the corporate funded greater than $2 billion in residence loans, with almost a billion of their residence state of Arizona.

They’re additionally very energetic in Colorado and California, and have a good presence in Nevada and Texas as effectively.

Whereas they’re licensed in most states nationally, they don’t appear to be out there in Delaware, Hawaii, Maine, New York, Rhode Island, Vermont, or West Virginia.

How one can Apply with Amerifirst Monetary

- You will get began immediately by visiting their web site and clicking “Apply Now”

- They provide a digital mortgage software powered by ICE that allows you to full most duties by yourself

- It’s additionally doable to browse their on-line mortgage officer (or department) listing first to search out somebody to work with close by

- As soon as your mortgage is submitted you possibly can handle it 24/7 through the net borrower portal

Amerifirst Monetary makes it tremendous straightforward to get began on your private home mortgage software.

Merely head to their web site and click on on the large “Apply Now” button and also you’ll be off to the races.

That may take you to their digital mortgage software powered by ICE that allows you to enter all of your private and monetary particulars electronically.

Then you possibly can hyperlink monetary accounts utilizing your credentials to keep away from having to scan/add or observe down your paperwork.

Moreover, you possibly can order your individual credit score report and eSign disclosures to hurry by the extra painstaking a part of the method in a matter of minutes.

As soon as your mortgage is submitted and accredited, you’ll obtain a to-do checklist with any situations that should be met to get to the end line.

You’ll additionally have the ability to observe and handle your mortgage through the net borrower portal, and get in contact together with your lending group if and when you may have questions.

Those that want a extra human contact can even go to an area department and/or browse the net mortgage officer listing to be taught extra concerning the people who work there.

It might even be advisable to talk with a mortgage officer first to debate mortgage pricing and out there mortgage applications, then proceed to the net mortgage software.

In any case, they make it actually easy to use for a mortgage and handle your mortgage from begin to end due to the newest know-how.

Shield Your Transaction Pre-Approval for Dwelling Patrons

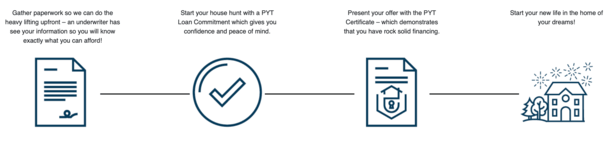

One perk to utilizing Amerifirst Monetary, particularly in the event you’re shopping for a house in a aggressive market, is their “Shield Your Transaction” mortgage dedication.

It goes past each a pre-qualification and pre-approval in that it’s underwritten upfront by an actual human mortgage underwriter.

In truth, the PYT even comes with financial assurance (as much as $15,000, with an extra $5,000 for first responders and lecturers), which represents their perception within the energy of your software.

So if the mortgage falls by and it seems to be the lender’s fault, you possibly can be entitled to that money, which can be shared with the vendor. This may occasionally strengthen your provide.

Subsequent to a money provide, they imagine it gives the best assurance that they’ll present financing on your residence buy.

And that would simply be sufficient to offer you edge versus different residence consumers on a sizzling residence.

It might additionally provide you with peace of thoughts within the course of, figuring out you possibly can really get financing when all is alleged and executed.

Mortgage Applications Supplied by Amerifirst Monetary

- Dwelling buy loans

- Refinance loans: fee and time period, money out, streamline

- Conforming residence loans

- Excessive-balance and jumbo residence loans

- FHA/USDA/VA loans

- Down cost help

- Inexperienced Worth Mortgage

- Fastened-rate and adjustable-rate choices out there

Amerifirst Monetary gives each residence buy loans and refinance loans, together with fee and time period, money out, and streamline refinances.

You will get financing on a major residence, together with townhomes/condos, together with a trip residence or 1-4 unit funding property.

They provide all the favored mortgage sorts, together with conforming loans backed by Fannie Mae and Freddie Mac, high-balance and jumbo loans, and government-backed choices like FHA, USDA, and VA loans.

In addition they provide an unique mortgage program referred to as the “Inexperienced Worth Mortgage” that gives a lowered rate of interest, charges, and discounted mortgage insurance coverage in case your property has a inexperienced rating of 75 or decrease.

You may additionally be eligible to obtain as much as 3.5% of the acquisition worth as a non-repayable present. All of the extra cause to go inexperienced!

By way of mortgage applications, you will get both a fixed-rate mortgage akin to a 30-year or 15-year fixed, or an adjustable-rate mortgage like a 7/1 or 5/1 ARM.

Amerifirst Monetary Mortgage Charges

One slight detrimental to Amerifirst Monetary is the truth that they don’t point out their mortgage rates anyplace on their web site.

As such, we don’t have any clues about their mortgage pricing relative to different banks and lenders on the market.

The identical goes for lender charges, which aren’t clearly listed on their web site to my data.

This implies you’ll must get in contact with a mortgage officer to debate charges and charges to make sure they’re competitively priced.

Be sure you evaluate their charges/charges with different lenders earlier than you proceed to the applying if you need peace of thoughts on pricing entrance.

Customer support and competence is at all times vital, particularly in the case of a house mortgage, however so is value.

Amerifirst Monetary Critiques

On Zillow, Amerifirst has a really spectacular 4.98-star score out of 5 from roughly 900 buyer evaluations, which is kind of spectacular given the quantity of suggestions.

On LendingTree, they’ve an ideal 5-star score, although it’s based mostly on nearly 30 evaluations. In addition they have a 100% beneficial rating there.

For those who’re searching for extra evaluations, you may as well take a look at native ones on Google for his or her brick-and-mortar branches nearest you.

Lastly, the corporate is Higher Enterprise Bureau accredited, and has been since 2014. They at present get pleasure from an ‘A+’ score based mostly on grievance historical past.

To sum it up, Amerifirst Monetary might be a strong selection for somebody buying a house (particularly a first-time buyer) due to their sturdy Shield Your Transaction mortgage approval and number of down cost help applications.

Amerifirst Monetary Professionals and Cons

The Good

- You’ll be able to apply for a house mortgage from any system in minutes

- Provide a digital mortgage software powered by ICE

- Plenty of mortgage applications to select from

- Reductions for many who buy a inexperienced residence

- Shield Your Transaction mortgage approval for residence consumers

- Glorious buyer evaluations from former prospects

- A+ BBB score, accredited enterprise since 2014

- Free mortgage calculators and mortgage dictionary on website

The Not

- Not out there in all states at present

- Don’t checklist mortgage charges or lender charges on their web site

(picture: nathanmac87)

[ad_2]

Source link