[ad_1]

With the financial stress introduced on by the COVID-19 pandemic, 2020 was extensively anticipated to be a yr the place client borrowing would endure historic change. And whereas the nation confronted document unemployment and lots of People struggled financially, borrowing habits—as proven in credit score report information—have largely remained secure.

There have been a couple of notable exceptions, nevertheless. Private mortgage debt, which for a number of years has been the fastest-growing debt class, noticed the largest change in 2020. The annual development in private mortgage borrowing was reduce almost in half, from 12% in 2019 to six% in 2020. Amid this total slowing, Era Z (the youngest era in our evaluation) grew their common private mortgage stability by 33% in 2020.

As a part of our ongoing analysis on debt within the U.S., Experian reviewed credit score report information to see how private mortgage debt modified previously yr and to know what impression the pandemic has had on borrowing. This evaluation compares yearly consultant information from 2019 with information from the third quarter (Q3) of 2020, the latest info out there.

Learn on for our insights and evaluation.

Total Private Mortgage Debt within the U.S. Grew in 2020

Although the nation’s excellent private mortgage debt grew in 2020, the speed at which the balances expanded was reduce in half—shrinking from 12% development in 2019 to simply 6% in 2020, in line with Experian information. This slowing marks a deviation from a six-year-long pattern that noticed private loans grow to be the fastest-growing kind of client debt within the nation. As of 2020, nevertheless, pupil mortgage and mortgage balances grew at a price sooner than private loans, growing by 24% and seven%, respectively.

Starting in 2009—on the heels of the Nice Recession—private mortgage balances started to shrink and continued to take action till 2014. This era of decline resulted in total private mortgage debt falling from $259 billion in 2008 to $171 billion in 2013. Excellent private mortgage balances started to rebound in 2014, and private loans turned one of many fastest-growing debt classes main as much as 2020.

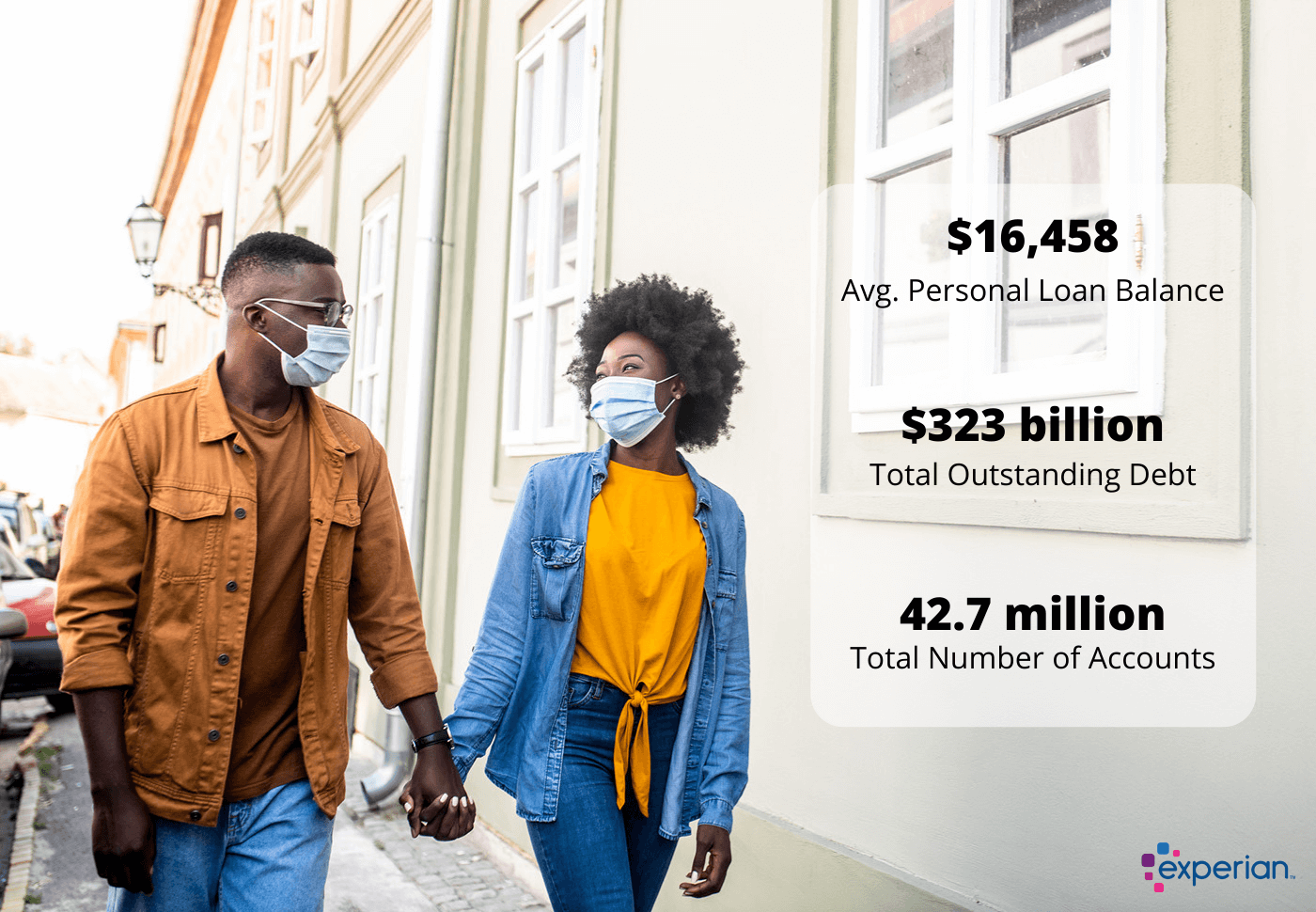

In Q3 2020, total private mortgage debt reached a brand new all-time excessive of $323 billion. This represented a 6%—$18 billion—enhance from $305 billion in 2019. Regardless of the rising balances, private mortgage debt nonetheless represents solely 2% of total debt within the U.S., forward of solely retail bank cards when it comes to whole stability.

Supply: Experian

Common Shopper Snapshot: Private Mortgage Balances

Although total private mortgage debt noticed development in 2020—in continuation of the six-year pattern—the typical quantity every client owes solely elevated by just one%, in line with Experian information.

As of Q3 2020, shoppers owed a mean of $16,458 in private loans, up $199 from $16,259 in 2019. This yr’s enhance in particular person common private mortgage debt comes on the heels of a number of years through which common client balances went down. In 2018 and 2019, common private mortgage balances per client shrank by 1% and 0.5%, respectively—a decline that occurred whereas total private mortgage debt elevated.

The distinction between total development and declining particular person balances is probably going defined by the growing variety of private mortgage accounts, which has been the pattern since 2013, in line with Experian information. With extra accounts, total debt stability can develop whereas the typical stability stays about the identical. Since 2013, the overall variety of private mortgage accounts has grown 90%, from 22 million to 43 million in Q3 2020.

Private Mortgage Debt Will increase in Some States, Falls Elsewhere

Throughout the U.S., the nation was break up when it got here to how shoppers’ common private mortgage debt modified previously yr. Shoppers in 27 states noticed their balances develop in 2020, whereas private mortgage debt balances fell within the remaining 23 states and the District of Columbia.

Among the many states the place shoppers’ balances elevated, almost two-thirds—17 states—noticed quantities owed develop by 4% or extra. Two states noticed double-digit proportion development.

Of the states the place client balances decreased, a little bit over half—16 states—noticed a lower of lower than 4% and solely two noticed double-digit proportion declines. Notably, within the 10 states that noticed balances drop probably the most, shoppers’ common FICO® Scores☉ had been persistently above the nationwide common of 710—a possible nod to the flexibility higher-score holders had in paying down debt over the previous yr.

Supply: Experian

Almost half of all states and the District of Columbia noticed their common private mortgage stability drop in 2020. The nation’s capital noticed the largest drop by far, almost doubling the lower seen within the second-ranked state—New Jersey. Vermont, Connecticut and North Dakota adopted carefully behind New Jersey to spherical out the states with the highest 5 greatest decreases in debt.

Shoppers within the District of Columbia decreased their common stability by 19.6% since 2019, in line with Experian information. This discount is consistent with different traits inside the district. In 2020, shoppers there additionally noticed their bank card debt drop by 20%—probably the most of any state.

Supply: Experian

Shoppers in additional than half of states—27 to be precise—noticed common private mortgage balances enhance since 2019. The best enhance was recorded in Kentucky, the place shoppers noticed their common private mortgage stability spike by 11%. Nebraska, Nevada, Maine and Wyoming adopted Kentucky because the states the place client balances noticed the best development in 2020.

Supply: Experian

Youthful Generations Drove Adjustments in Private Mortgage Debt

Because the time private mortgage debt started to extend in 2014, the composition of lenders issuing the debt has modified. In 2015, solely 22% of unsecured private loans had been issued by fintech lenders (online-based expertise firms), with conventional monetary establishments (together with brick-and-mortar banks and credit score unions) accounting for the remaining. That determine greater than doubled by 2019, when fintech lenders accounted for 49.4% of latest originations, in line with an Experian report.

The rising reputation of fintech lenders has many implications, considered one of which is the inclusion of youthful People within the borrowing pool. Amongst private loans issued by conventional banks, solely 28% had been taken out by millennials and members of Era Z, in line with Experian. In the meantime, 39.9% had been issued by fintech lenders, an indication of the shifting digital panorama and youthful generations’ affinity for fintech options.

By way of how a lot is being borrowed, members of Era Z noticed their private mortgage balances develop probably the most of any age group in 2020. These shoppers elevated their private mortgage balances by 33%, or $1,478, on common. Although millennials noticed a fraction of the expansion of their debt—millennials’ common stability elevated by simply 4%—the second-youngest era nonetheless recorded the second-highest spike in 2020.

Supply: Experian; Ages as of 2020

The expansion in private loans amongst youthful generations cannot all be traced to the elevated reputation of fintech lenders, although. As time’s gone on, many of those shoppers have reached an age the place taking out a private mortgage is extra widespread. Moreover, as these shoppers age, their common credit score scores typically enhance—opening the doorways to new borrowing alternatives. The confluence of those elements is probably going what’s driving the numerous debt development amongst youthful People.

On the similar time, the alternative sample is showing throughout the oldest generations. Child boomers have the best private mortgage balances of any group, however they’re rising this debt on the second slowest price. The silent era noticed nearly no stability change from 2019 to 2020, as many members of the era are retired and within the strategy of paring their debt down as they age by paying off mortgages, for instance.

Private Mortgage Delinquencies Decreased in 2020

Because the pandemic took maintain and the economic system started to droop, many nervous that customers would fall behind on their debt funds. Through the Nice Recession that started in 2007, delinquencies grew to document highs, and the impression of falling behind left an enduring stain on the economic system and people’ funds.

In an effort to attenuate widespread delinquency and different financial repercussions attributable to the pandemic, Congress and different establishments took preemptive measures by issuing reduction measures—together with laws within the type of the Coronavirus Assist, Aid and Financial Safety (CARES) Act—that gave debtors choices to assist them keep away from letting their accounts grow to be delinquent.

Paired with different elements, these measures have seemingly proved efficient up to now—at the least partly—as credit score report information present that throughout almost all money owed and time durations, shoppers have improved their delinquency charges since 2019.

Private mortgage delinquency charges noticed important enchancment previously yr, lowering by double-digit percentages throughout measures of delinquency. The ratio of non-public mortgage accounts severely delinquent—90 to 180 days overdue (DPD)—shrank by 35% from 1.37% to 0.89% between 2019 and Q3 2020, in line with Experian information. The portion of accounts 30 to 59 DPD diminished by 24% and accounts 60 to 89 DPD shrank by 17%.

Supply: Experian

Private loans weren’t the one credit score kind to see a lower in delinquencies. Actually, throughout the U.S., the ratio of all delinquent accounts shrank between 2019 and 2020, and this sample of decline was true for all debt sorts, in line with Experian information.

The explanations behind enhancements for pupil mortgage and mortgage are pretty clear: The CARES Act not solely suspended pupil mortgage reimbursement, nevertheless it issued steering for mortgage lenders, permitting many shoppers financially impacted by the pandemic to position their dwelling loans in forbearance.

The reason for the lower in private mortgage delinquency is extra opaque, nevertheless. Whereas the federal authorities urged lenders to work with debtors who had been struggling because of the pandemic, there was no clear mandate for private loans and different money owed. It is unclear to what extent private mortgage issuers labored with shoppers financially impacted by the pandemic, however there’s a chance that at the least a number of the improved delinquency charges could be attributable to lender lodging akin to lowered month-to-month funds.

How Did COVID-19 Impression Private Loans in 2020?

The COVID-19 pandemic has clearly impacted the way in which shoppers work together with private loans, each negatively and positively. Debtors nonetheless appear to be turning to those lump-sum fee choices, however total debt is rising at half the speed it did in previous years.

To know extra about how COVID-19 impacted shoppers’ determination to take a private mortgage, Experian surveyed a bunch of 186 People who had taken a private mortgage previously 12 months.

Of this group, solely 26% stated they took the mortgage due to direct monetary hardship from COVID-19. One other 24% stated the pandemic had some affect on their determination to take a brand new mortgage, however was not your entire cause for his or her doing so.

The overwhelming majority of these surveyed stated they had been assured of their capability to pay again their debt. A complete of 86% of respondents stated they will afford the month-to-month fee on their private mortgage, in line with the survey. The remaining 14% didn’t say they might afford their month-to-month fee.

Lastly, the pandemic hasn’t solely modified the methods debtors take into consideration taking out debt, nevertheless it’s modified how some lenders view candidates. In accordance with media experiences, the pandemic’s financial impression has brought on some lenders to reign within the variety of loans they issued. Any discount in lending that occurred might have contributed to the slowing total debt development.

Even when shoppers had maintained—and even elevated—their urge for food for private loans through the pandemic, with a discount in borrowing alternatives, debt development is certain to sluggish.

Credit score and Debt Developments in Altering Instances

Although preliminary debt information exhibits promising modifications—together with the slowed debt development and an improved delinquency price—it is necessary to acknowledge that this information is a snapshot taken throughout a turbulent interval. Moreover, most of those modifications occurred over a interval of lower than a yr and are topic to additional change as time goes on.

This evaluation appears to be like at the latest (upon date of publication) information from Q3 2020 and compares it with an annual snapshot for 2019 and different years cited. As time goes on, we are going to proceed to observe modifications to client credit score experiences and can present updates when notable change happens.

Methodology: The evaluation outcomes supplied are based mostly on an Experian-created statistically related combination sampling of our client credit score database that will embody use of the FICO® Rating 8 model. Completely different sampling parameters might generate completely different findings in contrast with different related evaluation. Analyzed credit score information didn’t comprise private identification info. Metro areas group counties and cities into particular geographic areas for inhabitants censuses and compilations of associated statistical information.

FICO® is a registered trademark of Honest Isaac Company within the U.S. and different international locations.

[ad_2]

Source link