[ad_1]

There are particular advantages to refinancing auto loans, however there are additionally some features that you need to watch out for earlier than you determine to refinance your automobile or truck. Whereas it is a certain manner that many take to economize within the type of decrease rates of interest (APR) and month-to-month automobile funds there are a lot of extra that both do not learn about refinancing or don’t take into account the financial savings advantage of doing so.

What’s automobile refinancing? It’s just like refinancing a mortgage however a much less complicated course of that’s quicker. Primarily your present auto mortgage is paid off from the unique lending establishment at a greater price by a brand new lender. It’s this discount within the price of curiosity that can decrease your month automobile funds and that will additionally assist you to repay your auto mortgage quicker. In some instances the discount in your auto mortgage rate of interest and funds may be dramatic. This alone is price investigating your choices, which may be executed rapidly on-line. In the present day free, no obligation auto mortgage refinance quotes may be discovered, secured and in contrast with just a little period of time and the press of a mouse.

Refinancing auto loans for individuals with a bad credit report historical past can also be accessible and a fantastic alternative. Out of all of the individuals who determine to refinance, you stand to appreciate the bottom rate of interest reductions and auto mortgage funds. If a 12 months or so in the past you acquired a sub-prime automobile mortgage with a excessive rate of interest due to a poor credit score historical past however have gained stability in employment and that is mirrored by on time automobile funds, you could now be certified for a considerably decrease rate of interest. It makes essentially the most sense so that you can make sure that you’re not paying greater than it’s a must to by refinancing your auto mortgage or not less than researching it.

If you select to refinance your present auto mortgage you may maintain the identical or diminished phrases (size of time) as your present mortgage, however at a decrease rate of interest, this can assist you to repay your automobile quicker. However you can too select to have decrease funds by extending the phrases that stay in your present mortgage. Doing this can lead to you paying extra curiosity over the lifetime of the automobile mortgage, even with a lowered rate of interest.

Hold this in thoughts, it’s most helpful so that you can refinance an auto mortgage ahead of later. You will note extra financial savings if you refinance your mortgage rapidly, inside one to 2 years, since many of the curiosity of an auto mortgage is ‘charged’ at first portion of the mortgage. You’ll save extra money, this might assist you to repay your automobile mortgage forward of schedule.

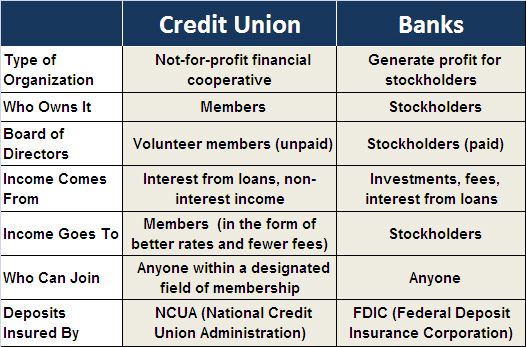

in case your present auto mortgage price and funds are extreme, now you could find aid. Comparability is the important thing right here. Your native financial institution or credit score union if you’re a member, are nice locations to start out. Most have a presence on line the place you can see them and different respected lenders keen to refinance your mortgage at their present, decrease charges and phrases. Examine not less than three lenders quotes on-line to seek out the bottom APR for refinancing auto loans and the most effective phrases, particularly for individuals with bad credit report.

[ad_2]

Source by Rhonda Strump