[ad_1]

After commencement, scholar loans can throw a wrench in your funds. The hefty funds typically really feel like an impediment to monetary freedom.

If in case you have the chance to repay scholar loans early, then you’ve a giant determination to make. It’d really feel like a simple option to get rid of scholar loans out of your life, it’s not at all times one of the best monetary transfer in some conditions.

Private finance isn’t one-size-fits-all. You’ll have to discover a number of components to find out whether or not to repay your scholar mortgage early.

Ought to I repay my scholar mortgage debt early?

Relying in your state of affairs, paying off your student loans is likely to be the fitting transfer. However in others eventualities, it makes extra sense to work on different monetary targets.

Listed below are a number of the questions it’s best to ask your self as you think about eliminating your scholar mortgage cost for good.

Do I’ve bank card debt?

Bank cards may be helpful monetary instruments. You should utilize bank cards to stretch your {dollars} additional via rewards methods. Plus, you’ve quick access to further credit score if you should cowl your bills in a pinch.

Nevertheless, it may be straightforward to get in over your head with bank card debt. With excessive rates of interest, bank card debt can add up rapidly.

If in case you have a whole lot of bank card debt, deal with paying down these balances earlier than making any further funds in your scholar loans.

Since scholar mortgage rates of interest are sometimes considerably decrease than bank card rates of interest, you’ll make extra progress by paying down your bank cards first. As an added bonus, you would possibly see a lift to your credit score rating in case you pay down your bank card with a excessive APR.

Do I’ve an emergency fund?

An emergency fund is a vital a part of a strong monetary basis. With an emergency fund, you’re higher ready to deal with something life throws your means. Whether or not you face unemployment or a significant automotive restore, an emergency fund can are available in to avoid wasting the day.

Most specialists suggest constructing an emergency fund with three to 6 months of bills. You may as well construct up your emergency fund by depositing your financial savings right into a high-yield financial savings checking account.

In case you don’t have an emergency fund in place, work on that aim earlier than paying off your scholar loans. But when you have already got an emergency fund, then it is likely to be clever to repay your scholar mortgage early.

Am I contributing to my retirement?

Retirement is a significant expense that takes years to avoid wasting for. It’s necessary to start out constructing your retirement financial savings as quickly as attainable.

If you’re nonetheless in your 20s, you’ve the added alternative to benefit from the results of compound curiosity. Compounding takes your retirement account to the subsequent stage.

Are you not saving for retirement but? Then it’s sensible to deal with increase your retirement plan earlier than tackling your entire scholar loans. After you have a retirement plan in place, you possibly can determine if paying off your scholar loans early matches into the massive plan.

What sorts of scholar loans do I’ve?

Debtors with federal scholar loans have entry to a number of packages that can disappear by paying off loans early. For instance, making extra loan payments under PSLF isn’t a good suggestion.

However when you’ve got personal scholar loans, the selection is fully totally different. Since these loans aren’t protected by federal packages and advantages, it will possibly make sense to repay your loans early. That’s — in case you don’t have a extra urgent monetary subject to handle.

As a holder of personal loans, the choice is making the most of low-interest charges with student loan refinancing. A decrease charge permits you to use the additional cash in your funds towards one other monetary aim, like a house down cost or beefing up your retirement financial savings.

Does my scholar mortgage have an early prepayment penalty?

In case you determine that paying off your scholar mortgage steadiness early is the fitting selection, don’t overlook to test your loans have prepayment penalties. You don’t wish to be compelled to pay extreme charges for the straightforward proper to repay your mortgage upfront.

Unsure if there’s a prepayment penalty? Ask your lender for clarification.

How rapidly are you able to repay your scholar loans?

There are a number of cost choices you possibly can think about in case you’ve determined that is the fitting path for you. Listed below are a number of the methods to repay your scholar loans early.

Biweekly funds

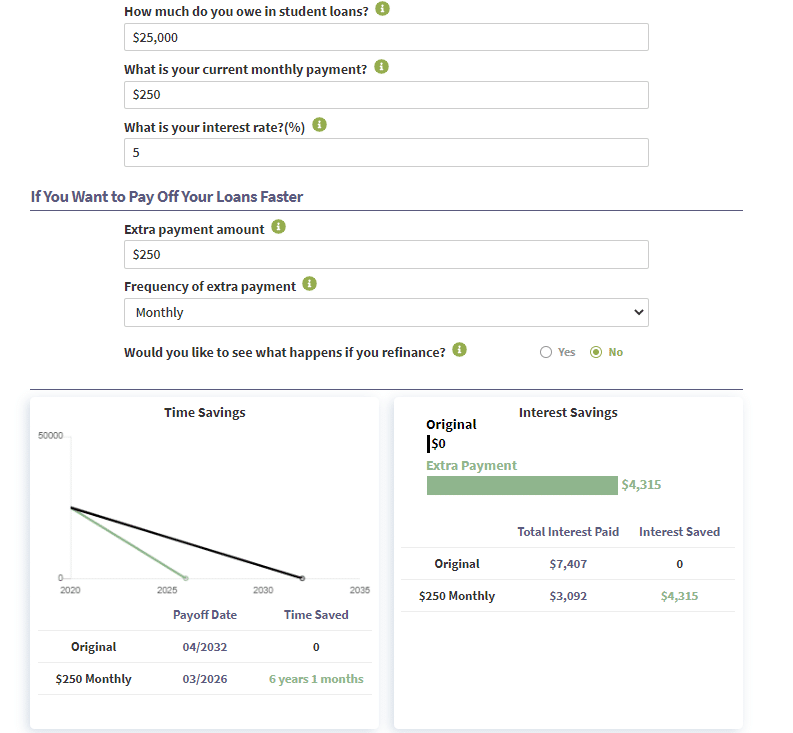

Let’s say that you’ve got a scholar mortgage steadiness of $25,000 at a 5% rate of interest. Presently, you’re making month-to-month funds of $250. However you determine to make biweekly funds to complete $500 every month.

Right here’s what you’ll see when utilizing the Student Loan Planner Calculator.

Because of your further funds, you possibly can repay your mortgage six years and one month early! That’s a big enchancment, particularly since you’ll save $4,315 in curiosity funds alongside the way in which.

Lump-sum funds

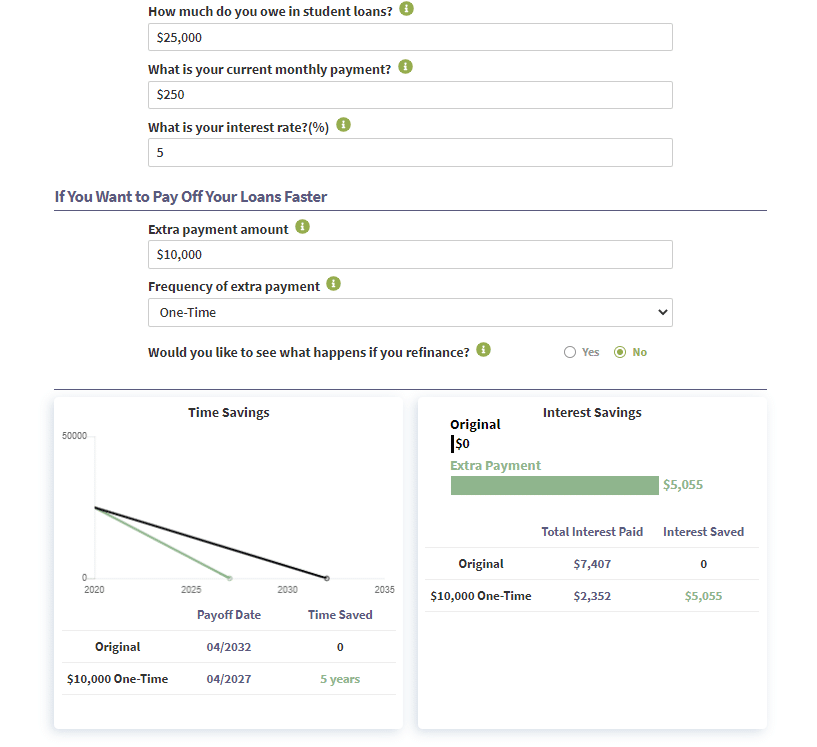

Let’s say that you’ve got a scholar mortgage steadiness of $25,000 at a 5% rate of interest. Presently, you’re making month-to-month funds of $250. However you determine to make a lump sum cost of $10,000.

Right here’s what you’ll see when utilizing the Student Loan Planner Calculator.

Because of an additional lump-sum cost, you possibly can repay your mortgage 5 years early! It’s necessary to notice that you may’ve paid this mortgage off sooner with the biweekly technique. However you’ll save $5,055 in curiosity funds.

Refinance

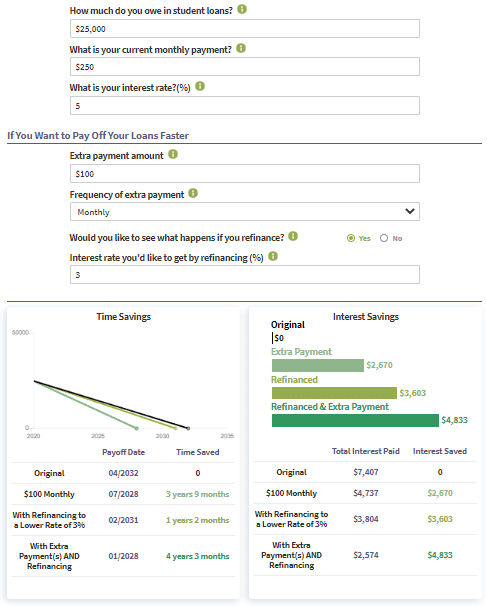

Let’s say that you’ve got a scholar mortgage steadiness of $25,000 at a 5% rate of interest. Presently, you’re making month-to-month debt funds of $350. However you determine to make further month-to-month funds to complete $500 every month. Plus, you possibly can refinance your to raised mortgage phrases via a non-public lender with a decrease rate of interest of three%.

Right here’s how a lot it can save you via refinancing.

Because of your further funds and a refinance, you possibly can repay your mortgage 4 years and three months early! That’s super progress. Alongside the way in which, you’ll save $4,833 in curiosity funds.

The underside line

School graduates know that when their grace interval is up, the fixed have to make month-to-month scholar mortgage funds is usually a monetary burden. In extraordinarily troublesome conditions, you possibly can faucet into choices resembling forbearance or deferment as a final resort. Nevertheless it’s higher to take away these loans out of your life for good, earlier than it will get to that time.

In case you’re able to sort out your scholar mortgage debt, then benefit from our free scholar mortgage calculator. Discover your choices primarily based on biweekly, lump-sum or extra monthly payments.

[ad_2]

Source link