[ad_1]

Studying Time: 5 minutes

Your tax return is perhaps a excessive level in your 12 months, particularly in the event you just lately grew to become a house owner. Final 12 months’s common refund, filed mid-year in July due to the pandemic, was $2,741.* This quantity might improve in the event you personal a house and have dependents or kids.

Your house owner’s tax information for 2021: 5 massive breaks and three extra advantages

This 12 months, the IRS began accepting 2020 tax returns slightly later — starting February 12, 2021, with the normal submitting deadline of April 15. Tax season could also be extra difficult for some, relying on the way you have been affected by the pandemic.

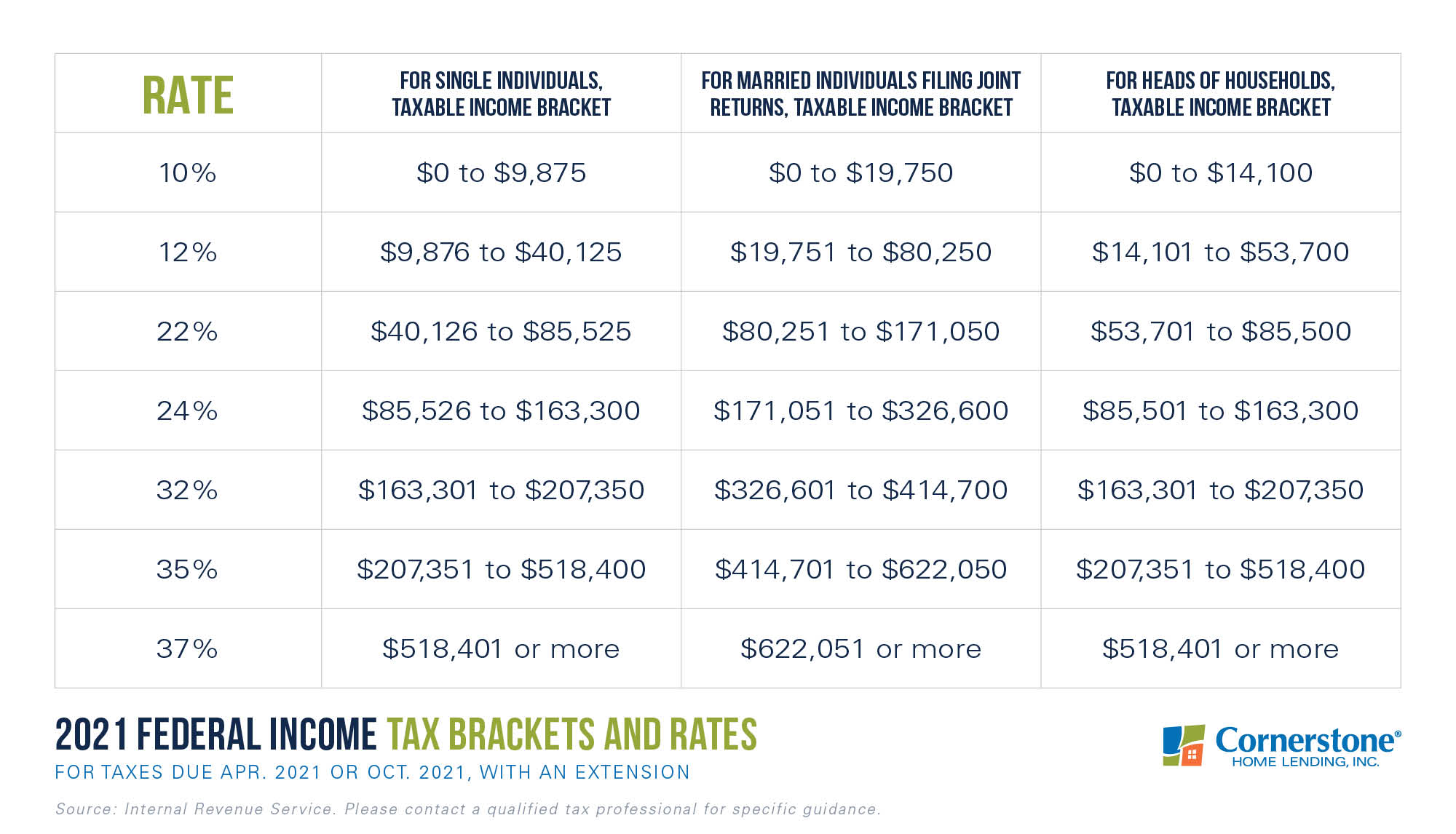

Accounting for annual inflation, tax brackets, in addition to the usual deduction, rose for taxes filed in 2020:

As you’ve in all probability skilled, the reformed tax legislation lets shoppers preserve extra money. Decrease tax charges and the next commonplace deduction make this doable. (Trying forward, here’s where you can find the brand new commonplace deduction/brackets for the taxable 12 months of 2021.)

With the next commonplace deduction, there could also be fewer taxpayers who itemize (listing out bills that may be subtracted from annual taxes). For those who don’t have a lot to itemize, taking the usual deduction exempts two occasions as a lot of your earnings.

However in the event you personal a house, itemizing some or all of those tax breaks might probably convey extra financial savings:

1. House fairness mortgage/HELOC curiosity.

- Now you possibly can solely deduct house fairness curiosity that’s been used for renovations — a major change from years previous. However for those planning to renovate, this modification to the 2018 tax law provides greater advantages.

- For those who’re eligible to deduct curiosity for renovations, that quantity will go towards your complete deduction restrict of $750,000 in mortgage curiosity. (See beneath.)

- This sort of mortgage could also be labeled as a house fairness line of credit score (HELOC), house fairness mortgage, or second mortgage.

2. Mortgage curiosity.

- The max for mortgage curiosity deductions lowered in 2018, dropping from $1,000,000 to $750,000. This deduction can embody a secondary residence. Your secondary house may also be a rental, cellular house, or boat, although it’s a good suggestion to contact your CPA for particulars.

- For houses financed before December 15, 2017, the previous deduction quantity nonetheless applies.

- You’ll discover all deductible mortgage curiosity in your Mortgage Curiosity Assertion, or your lender-provided IRS Type 1098. States by which you have to file a state revenue tax return could mean you can write off your mortgage curiosity, even in the event you don’t itemize in your federal kind.

3. Mortgage factors.

- For those who paid mortgage factors — charged by your lender to lower your rate of interest — you possibly can embody them in your deductions. Point deductions may be limited for houses that value over $750,000.

- You can deduct all of your factors at one time for the tax 12 months they have been paid. (For those who purchased a home in 2020, for instance.)

- Or, you possibly can deduct steadily, writing off a share of your factors for yearly you’ve got your mortgage. Every level is the same as 1 % of your complete mortgage quantity.

With mortgage charges nonetheless at document lows, now’s a primary time to promote and relocate. Connect with a neighborhood mortgage officer to discover ways to leverage your refund.

4. Some house enhancements.

- House renovations thought-about a medical expense, together with gear prices and charges for set up, might be absolutely deducted. (On a associated observe, you might be able to deduct unreimbursed medical bills that exceed 7.5 % of your AGI, or Adjusted Gross Revenue.)

- Examples of medically wanted house renos embody ramps, stairway and doorway modifications, help bars, new retailers or fixtures, and warning methods, so long as they don’t improve your property’s worth.

- You can additionally get a credit score for as much as 26 percent of the cost of putting in photo voltaic panels, photo voltaic water heaters, and different types of photo voltaic power.

5. State/native taxes.

- Tax reform also restricted deductions for state and native taxes (SALT), however the excellent news is that this write-off wasn’t eradicated.

- For taxes paid in 2020, the full deductible quantity per taxpayer for property, gross sales, and revenue taxes is capped at $10,000. For those who purchased and bought a house final 12 months, you possibly can deduct a portion of your former property’s taxes.

- It’s best to see a tax profit in most elements of the U.S., besides in higher-tax areas. However since a SALT deduction can solely be used for a combo of state/native property taxes and both state/native gross sales or revenue taxes, itemizing can get difficult. That is one other good time to seek the advice of your CPA.

Whereas tax deductions assist offset your taxable revenue, you might also be eligible for some tax credit, which assist lower how a lot you pay in taxes:

6. Baby tax credit score.

- For those who’re a house owner with kids or different dependents, it’s possible you’ll admire that the max Baby Tax Credit score doubled following the reform in 2017.

- The credit score increased to up to $2,000 for every little one who qualifies and maxes out at $400,000 in revenue for joint-filing married {couples}. A $500 Credit score for Different Dependents could also be obtainable for any further dependents a taxpayer can’t declare.

- With greater revenue limits, extra households are eligible and will get extra again. And, as much as $1,400 of the Baby Tax Credit score could also be refundable because the Further Baby Tax Credit score, making it doable to get a refund even in the event you don’t owe tax. The 2020 Adoption Credit score additionally sits at $14,300 per little one.

7. Restoration rebate credit score.

- For those who obtained an Financial Impression Cost in 2020 for COVID aid, you’ll want the accompanying Notice 1444 to your tax data.

- You can be eligible to claim the Recovery Rebate Credit when submitting your 2020 taxes in case your Financial Impression Cost was underneath $1,200 ($2,400 for married submitting collectively), plus $500 for qualifying kids. You may also qualify in the event you didn’t obtain an Financial Impression Cost.

- To file, you’ll have to fill out the Recovery Rebate Credit Worksheet on 2020 Type 1040 or 1040-SR, used to tally the quantity of credit score you might be able to declare.

8. Retirement contributions.

- Just like the Baby Tax Credit score, deductions for retirement account contributions could not technically be homeowner-specific however are in all probability going to use. A brand new tax change in 2019 gave anybody placing cash towards retirement a much bigger break.

- Limits on IRA contributions elevated as much as $6,000, whereas max contributions for 401(ok)s even have risen to $19,500.

- For taxpayers age 50 and older, you possibly can add $1,000 further to your IRA contribution or $6,500 further to your 401(ok). You sometimes can’t contribute greater than you make. There’s additionally a retirement Saver’s Credit of $1,000 ($2,000 for married submitting collectively), so long as you meet revenue {qualifications}.

Nonetheless, there are just a few home-related bills you possibly can’t deduct for 2020: house owner’s affiliation (HOA) dues, house appraisal charges, house owner’s insurance coverage, and the price of any house renovations that aren’t required for medical functions. Most of those tax adjustments are enacted by means of 2025. And in the event you’ve began working freelance on account of the pandemic, this can be the 12 months to look into the home office deduction.

Are you able to money in your tax return for a brand-new place?

As a house owner, it’s possible you’ll be getting extra money again, and you possibly can use these funds towards a brand new down cost. A much bigger home. Extra outside area. Even a transfer to a extra inexpensive zip code, in the event you’re working remotely. Prequalify and discover out what’s doable.

*”Submitting Season Statistics for Week Ending July 24, 2020.” IRS, 2020.

For academic functions solely. Cornerstone House Lending, Inc. and its associates don’t present tax recommendation. Please seek the advice of your skilled tax advisor for particular steerage.

Sources deemed dependable however not assured.

[ad_2]

Source link