[ad_1]

Britain faces a protracted recession and the worst squeeze on dwelling requirements in additional than 60 years, the Financial institution of England warned on Thursday, because it raised rates of interest sharply and forecast inflation would hit 13 per cent by the tip of the yr.

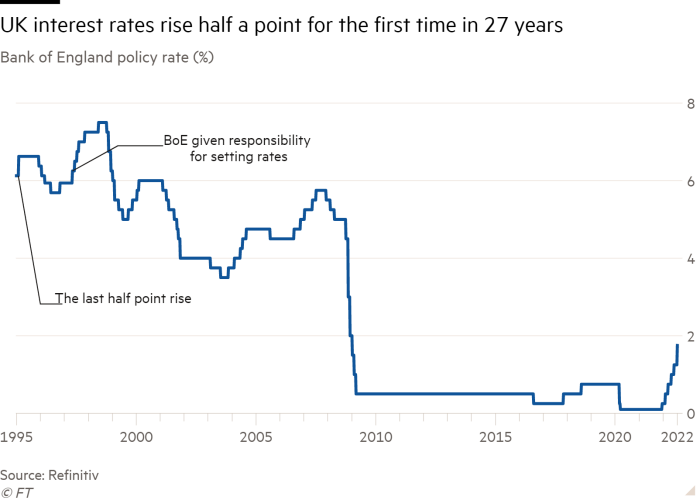

Eight of the Financial Coverage Committee’s 9 members voted to lift rates of interest by 0.5 proportion factors to 1.75 per cent, the largest enhance in 27 years.

This follows aggressive steps from the European Central Financial institution and US Federal Reserve within the face of hovering inflation. Silvana Tenreyro, an exterior member, voted towards the bulk for a smaller 0.25 proportion level rise.

The BoE stated that due to the newest surge in fuel costs, it now anticipated inflation to rise above 13 per cent on the finish of the yr — a lot increased than its Could forecast — and to stay at “very elevated ranges” all through 2023 earlier than falling again to the two per cent goal in two years’ time.

The pound slipped as a lot as 0.4 per cent to $1.209 after the information, whereas the yield on 10-year UK authorities bonds fell 0.07 proportion factors to 1.85 per cent.

The BoE is beneath rising political strain to deal with inflation after overseas secretary Liz Truss stated she would look to vary its mandate if she wins the Tory management contest and turns into UK prime minister.

With wages rising at round half the speed of inflation, BoE forecasts confirmed that households’ post-tax revenue would fall in actual phrases in each 2022 and 2023, even after factoring within the fiscal assist the federal government introduced in Could. The height-to-trough decline of greater than 5 per cent in family revenue could be the worst on document, with information stretching again to the Sixties.

Even with households working down their financial savings, shopper spending was set to fall over the subsequent yr, stated the BoE, dragging down financial development. Its forecasts confirmed a a lot deeper contraction in gross home product than it forecast in Could, with the financial system coming into recession within the fourth quarter of 2022 and persevering with to shrink for 5 successive quarters.

A peak-to-trough fall in GDP of two.1 per cent could be similar to that seen within the early Nineteen Nineties and the BoE stated that even as soon as the financial system got here out of recession, it anticipated development to be “very weak by historic requirements”.

The MPC stated coverage was “not on a preset path”, suggesting that the 50 foundation level fee enhance was not essentially the primary of many.

The BoE’s central forecast, which is predicated on market expectations of rates of interest rising to three per cent subsequent yr, confirmed inflation nonetheless at double digits within the third quarter of 2023, however falling again to the central financial institution’s 2 per cent goal a yr later. If the BoE took no additional coverage motion, its forecasts present inflation would nonetheless fall under 2 per cent by the tip of 2024.

The BoE stated the uncertainty round its central forecast — which assumes power costs will comply with market expectations for the subsequent six months however then stay unchanged — was “exceptionally massive” however that various eventualities it revealed nonetheless confirmed “very excessive near-term inflation, a fall in GDP over the subsequent yr and a marked decline in inflation thereafter”.

Rishi Sunak, former chancellor, stated the projected surge in inflation above 13 per cent strengthened his declare that his Tory management rival Truss could be reckless to extend borrowing and reduce taxes now.

“The Financial institution has acted in the present day and it’s crucial that any future authorities grips inflation, not exacerbates it,” he stated. “Growing borrowing will put upward strain on rates of interest, which can imply elevated funds on individuals’s mortgages.”

Sunak’s staff stated the 0.5 proportion level rise in rates of interest would price the Treasury greater than £6bn in increased debt servicing prices.

Truss has claimed that Sunak is partly liable for pushing Britain in the direction of recession, because of the sequence of tax rises he launched as chancellor.

[ad_2]

Source link