[ad_1]

Studying Time: 2 minutes

Mortgage charges have dropped over a full proportion level inside the previous yr, hitting new lows 16 occasions. This can be a sturdy driver towards homeownership: Right now’s decrease charges give shoppers much more advantages.

Let’s check out the highest three:

- Downsize or transfer up. Low charges open up alternatives to promote and transfer into a brand new home, whether or not it’s greater and higher or smaller and positioned in a extra fascinating place. You could possibly put your fairness positive aspects (hovering to an impressive average of $17,000) out of your present dwelling towards a brand new down fee — securing extra room if you’re working at home or have youngsters studying remotely.

- Buy your first dwelling. The non-financial and monetary advantages of changing into a house owner are well-documented. However what issues is deciding when the timing is true. That is solely so that you can decide, however it might assist to know that now is a perfect time to buy if you happen to really feel that different elements fall into place. Take a better have a look at how a lot it could cost you to wait.

- Refinance. In the event you’re already a house owner, it might be useful to consider refinancing. This could be a good solution to lock in a decrease fee, together with a decrease month-to-month fee, and see substantial financial savings over time. However upfront closing prices may apply. You’ll be able to learn on to reply the query: Is refinancing right for you?

Are you going to avoid wasting more cash if you happen to commerce up, lease, or purchase? There’s only one way to decide.

Why 2021 may very well be an ideal yr for anybody who’s prepared to purchase

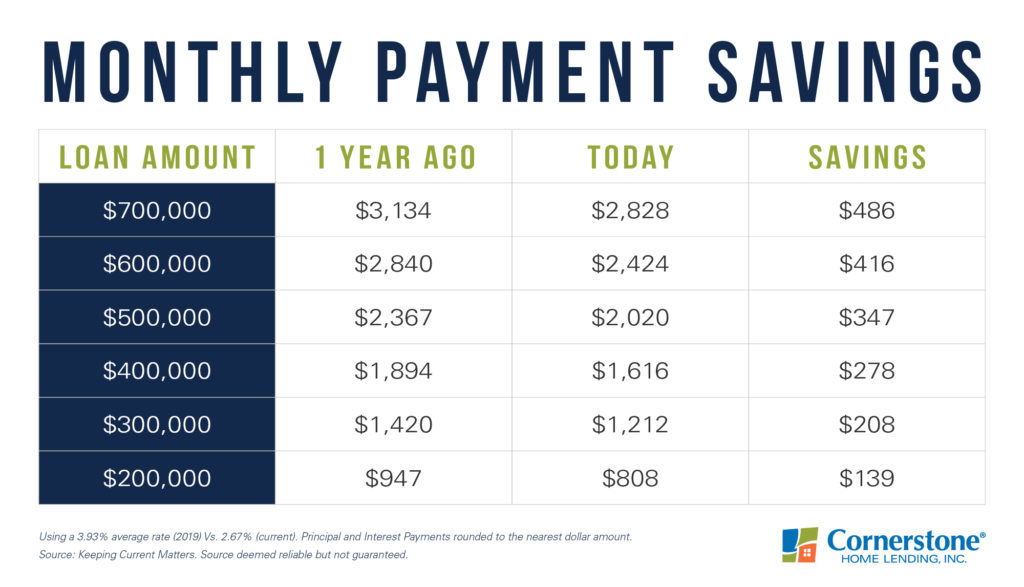

Slightly over a yr in the past, mortgage charges have been considerably larger, sitting at around 3.93 percent. You, like many individuals, might have been ready for market circumstances to enhance to make your transfer. Current record-low rates have helped homeownership to grow to be extra inexpensive and attainable than it was only one yr earlier than.

This chart depicts how a lot you would possibly save when shopping for at as we speak’s (early 2021) charges in comparison with the quantity you possibly can have paid final yr, additionally relying on your property’s buy worth:

This can be a time if you’re prone to get extra home to your cash and may pay much less every month to your mortgage.

Right now’s charges are traditionally low: See how a lot you possibly can save

Getting prequalified is the primary and most vital step to take to learn the way far more home you’ll be able to afford at as we speak’s low charges. It’ll additionally offer you your new house-hunting worth vary. The icing on the cake? It takes just some minutes. Utilizing our free LoanFly app, you’ll be able to prequalify from wherever. Make 2021 your year to purchase.

Whereas refinancing may make a major distinction within the quantity you pay every month, there are different prices it’s best to take into account. Plus, your finance fees could also be larger over the lifetime of the mortgage.

For instructional functions solely. Please contact your certified skilled for particular steering.

Sources deemed dependable however not assured.

[ad_2]

Source link