[ad_1]

“After I left dental college, I used to be capable of pay for it with out taking out debt!” – 65-year-old dentist

If you hear folks say that their technology may repay their scholar debt or work by way of college, they don’t fairly perceive how completely different it’s right this moment for the common dentist.

The price of all the pieces has gone up over the past 40 years, however dental college tuition has grown a lot quicker than the value of housing, vehicles, and even the average dentist salary.

Let’s look at how a lot the panorama has modified over the past 4 many years.

The price of dental college 40 years in the past

It’s 1978.

The Bee Gees are dominating the music charts with “Stayin’ Alive” and “How Deep Is Your Love”. Queen is up there with “We Will Rock You/We Are The Champions”. “Macho Man” & “YMCA” had been launched by The Village Individuals. Funkadelic launched what is taken into account one of many best funk albums of all time One Nation Underneath a Groove.

Star Wars: Episode IV, Superman, Grease and Jaws 2 are blockbuster hits.

And…dental college prices lower than $5,000 per yr.

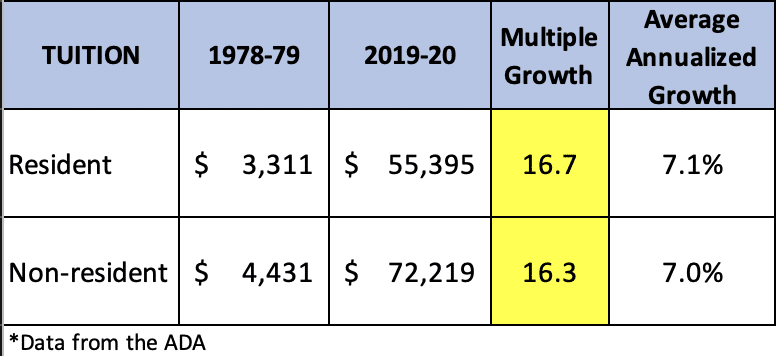

Extra particularly, resident tuition averaged $3,311 and non-resident tuition averaged $4,431 based on the Council on Dental Education.

Clearly, dental college tuition has elevated considerably since then. However how does it examine to the price of different issues 40 years in the past in comparison with right this moment?

First, let’s begin by wanting on the cost of dental school right this moment.

Dental college tuition right this moment

In line with the American Dental Association, the common first yr tuition for dental college for the 2019-2020 college yr was $55,395 for residents and $72,219 for non-resident dental college students. Non-public dental college will be much more costly than that.

That’s a serious enhance over what it was 40+ years in the past. However massive numbers and compound development can play methods on us. Let’s check out the way it’s grown from a dollars-perspective towards the common annual development price.

Dental college tuition is about 16x dearer than it was 41 years in the past. That works out to a 7% common development price in tuition per yr for each resident and non-resident college students.

However this doesn’t inform us the entire story, as a result of we have to see how dentists’ salaries have modified over time, too.

How should dentists earn right this moment vs. 40 years in the past

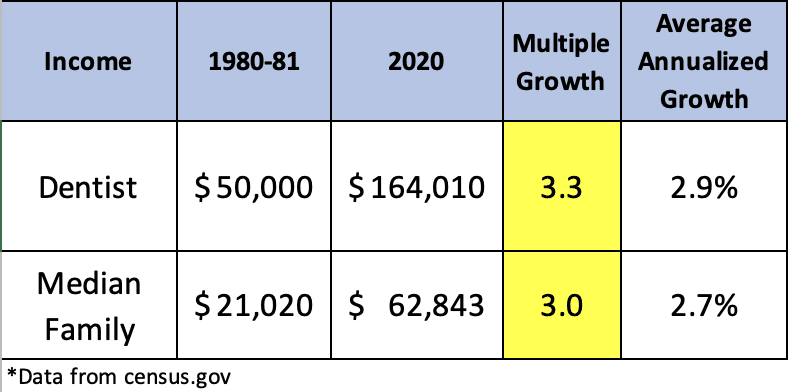

The median wage of dentists right this moment is $164,010 based on the Bureau of Labor Statistics. A dentist’s earnings will depend on many elements like apply possession, working towards in main cities versus rural cities, and the varieties of procedures executed within the workplace. Despite the fact that there is usually a big selection in dentist salaries, let’s simply go along with the median quantity for now.

Again in 1980, a dentist’s earnings was round $50,000 based on St. Louis Fed data versus $164,000 right this moment.

.

As you possibly can see, the dentist earnings in addition to the median household earnings has gone up about 3x over the past 40 years or ~3% common annualized development, effectively in need of the 7% development in dental college price.

Key level: Dentist earnings has risen 3x, however tuition has risen 16x over the past 40 years.

Now let’s see how the rise of dental college compares to different way of life objects like dwelling costs and automobile costs. Did some other main purchases develop on the tempo of dental college? Does something come shut?

How costs modified over 40 years

Now we all know that dental college is 16x dearer than it was 40 years in the past however earnings is just 3x increased.

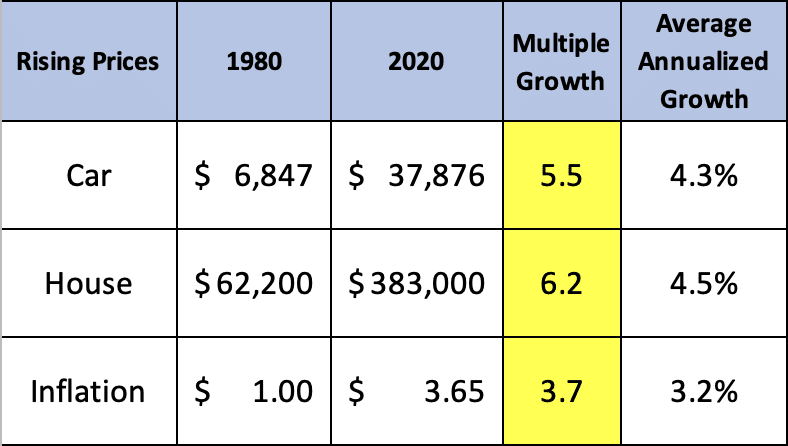

Lastly, let’s check out different main purchases and inflation as a comparability to the rising price of dental college:

*Automotive information from Kelly Blue Book, Inflation data, Housing information from census.gov

If we simply take a look at the inflation information, the price of all the pieces in mixture has gone up by 3.7x over the past 40 years (3.2% common annualized return).

That’s proper concerning the price of development for the median household earnings in addition to dentist earnings.

Homes and vehicles have grown at a quicker tempo than that, however are nonetheless at a fraction of the a number of development of the dental college price.

Affordability of Dental Faculty In the present day vs 40 Years In the past

In 1979, it made a whole lot of monetary sense to develop into a dentist. The entire price of faculty could be underneath $20,000 and you may earn $30,000 extra per yr than the median household ($50,000 versus $21,000).

Dental college tuition and costs had been insanely inexpensive. A dentist may make extra in a yr working towards dentistry than it price to go to 4 years of dental college.

In the present day is way completely different nevertheless.

The entire price of attending dental school can simply eclipse $300,000. Certain, dentists make $100,000 or greater than the median family earnings, nevertheless it pushes off the break-even level and isn’t practically as inexpensive because it was earlier than.

The price of dental college has gone from about 40% of a dentist’s wage in 1980 to 200% in 2020. In different phrases, dental college has gotten 5x dearer than it was 40 years in the past when in comparison with the potential earnings.

That additional expense additionally requires a special mortgage reimbursement technique than 40 years in the past.

With right this moment’s scholar mortgage guidelines, we’d in all probability advise a dentist from 1980 to repay their loans in full in a short time whereas a dentist right this moment would possibly need to go on an earnings pushed reimbursement plan based mostly upon their debt to earnings which pushes out mortgage reimbursement to twenty or 25 years.

The subsequent time a 60- or 70-year-old dentist wonders why you could have dental scholar debt regardless of making residing, saying they might pay for college rapidly — you possibly can inform them why.

Is dental college nonetheless value it? We expect it’s, however the math is completely different than it was 40 years in the past.

Questioning one of the simplest ways to pay again your dental college debt?

Dental college debt doesn’t need to be a burden. Pupil mortgage reimbursement for dentists can match round your profession objectives whether or not it’s as an affiliate, apply proprietor or specialist.

For those who owe greater than 1.25x your wage in federal scholar loans, then a student loan consult will assist you determine the optimum strategy to pay again your scholar loans whereas pursuing your profession path. The typical dentist we work with has round $396,000 in scholar loans, so that you’re not alone, and we may also help.

For any non-public loans with excessive rates of interest, attempt reducing your rate of interest by refinancing your student loans.

Ultimately, your scholar mortgage debt doesn’t need to be a burden regardless that the fee is way larger than it was many years in the past. There’s a reimbursement possibility that may work greatest on your particular state of affairs.

[ad_2]

Source link