[ad_1]

Mortgage charges forecast for March 2021

Earlier than 2020, nobody would have thought mortgage charges creeping towards 3% was a nasty factor.

However every little thing is relative.

In early 2021, the 30-year mortgage price bottomed out at 2.65% however is now 2.81% in accordance with Freddie Mac.

We are actually in a rising price surroundings. Charges are nonetheless ridiculously low, however forever-dropping charges needed to come to an finish someday.

Need to seize a number of the lowest charges in historical past? You would possibly wish to lock in now.

Find and lock a low rate today. (Feb 18th, 2021)

On this article (Skip to…)

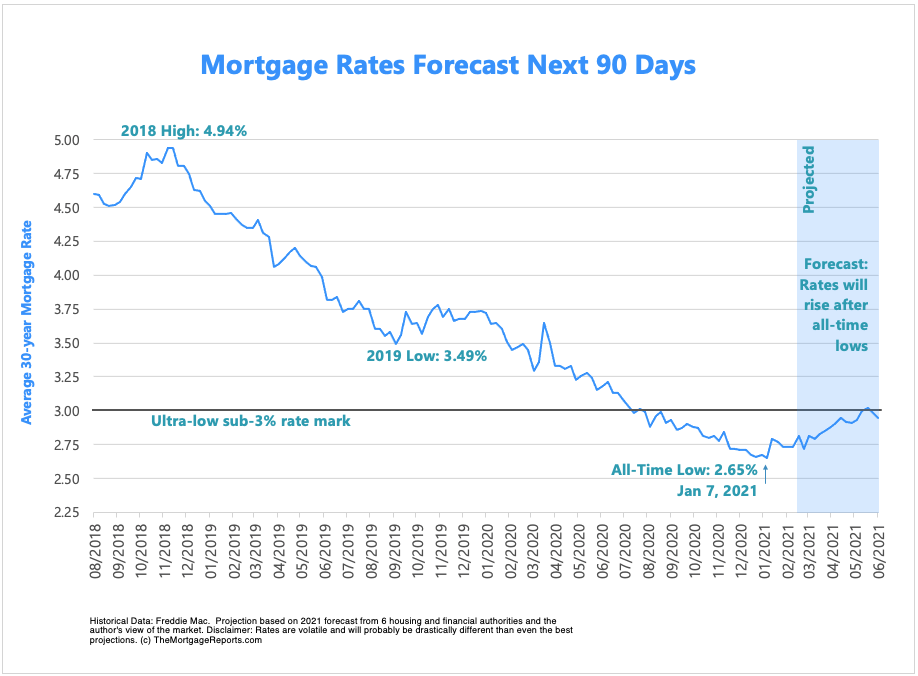

Mortgage charges subsequent 90 days

This chart reveals previous mortgage price developments, plus predictions for the following 90 days based mostly on present occasions and 2021 forecasts from main housing authorities.

Lock in today’s rates before they rise. (Feb 18th, 2021)

Predictions for March 2021

Listed here are developments we see on the horizon within the upcoming month and 12 months.

Democrat-controlled Congress may put upward stress on charges

The Georgia senate runoff election decided who would management Congress, therefore the nationwide curiosity.

Democrats gained each seats, making the Senate a 50-50 break up between Republicans and Democrats. However Vice President Kamala Harris would be the tie breaker, primarily giving Democrats a 51-50 majority.

It is a massive deal for mortgage charges as a result of buyers predict a Democrat-controlled Congress will go stimulus and different spending measures extra simply. That is unhealthy for charges for 2 causes.

First, stimulus efforts and different authorities packages are likely to raise the financial system. Customers spend extra and companies begin hiring. A warmer financial system can result in inflation, which is unhealthy for mortgage charges. Plus, the Fed might finish the rate-reducing packages it launched post-COVID if the financial system recovers sooner than anticipated.

Second, larger authorities spending means bigger bond issuance. The federal government points bonds (debt) to pay for help packages.

Mortgage charges are tied to bond costs. So if the federal government floods the market with bonds, bond costs go down and rates of interest on these bonds rise (costs and charges transfer in reverse instructions). Mortgage charges are based mostly on these bonds.

If that rationalization was a bit an excessive amount of, simply keep in mind that extra authorities spending can result in increased mortgage charges.

And charges are already beginning to spike, even earlier than any laws is launched.

In the event you’d wish to reap the benefits of sub-3% charges whereas they’re nonetheless round, you would possibly wish to act quick.

The excellent news: the Fed plans to take care of ‘straightforward cash’ insurance policies for the foreseeable future

As a counterweight to potential increased Democratic spending, the Fed reassured markets that it has no plans to finish “straightforward cash” insurance policies any time quickly.

Minutes from the January 2021 Fed assembly revealed inside settlement that the financial system is way from purpose ranges.

That is excellent news for mortgage customers.

Mortgage charges are within the high-2s largely as a result of Fed actions preserve them artificially low.

The group presently purchases $120 billion in bonds per 30 days, $40 billion of that are for mortgage-backed securities, the bonds that decide mortgage charges.

If the Fed states a timeline to cut back these purchases, 2021 might be a repeat of 2013.

The 12 months 2013 was one of many worst years on document for price will increase. The 30-year price went from 3.35% on Might 2 to 4.46% on June 27 in accordance with Freddie Mac. That’s a rise of virtually $200 per 30 days on a $300,000 mortgage — in 8 weeks.

In 2013, the cost on a $300,000 mortgage to elevated by $200 per 30 days in 8 weeks.

Markets are all the time forward-looking. If the Fed ideas their hand about tapering stimulus, the market may react violently and charges may skyrocket.

Remember that, in 2012 and 2013, charges saved hitting all-time lows earlier than leaping skyward. And that’s just about the story of mortgage charges in 2020 and early 2021. Are we due for an enormous soar?

Perhaps. However we should always see continued low charges so long as the Fed retains quiet about any plans to cut back mortgage bond purchases.

Lock in today’s rates. Start here. (Feb 18th, 2021)

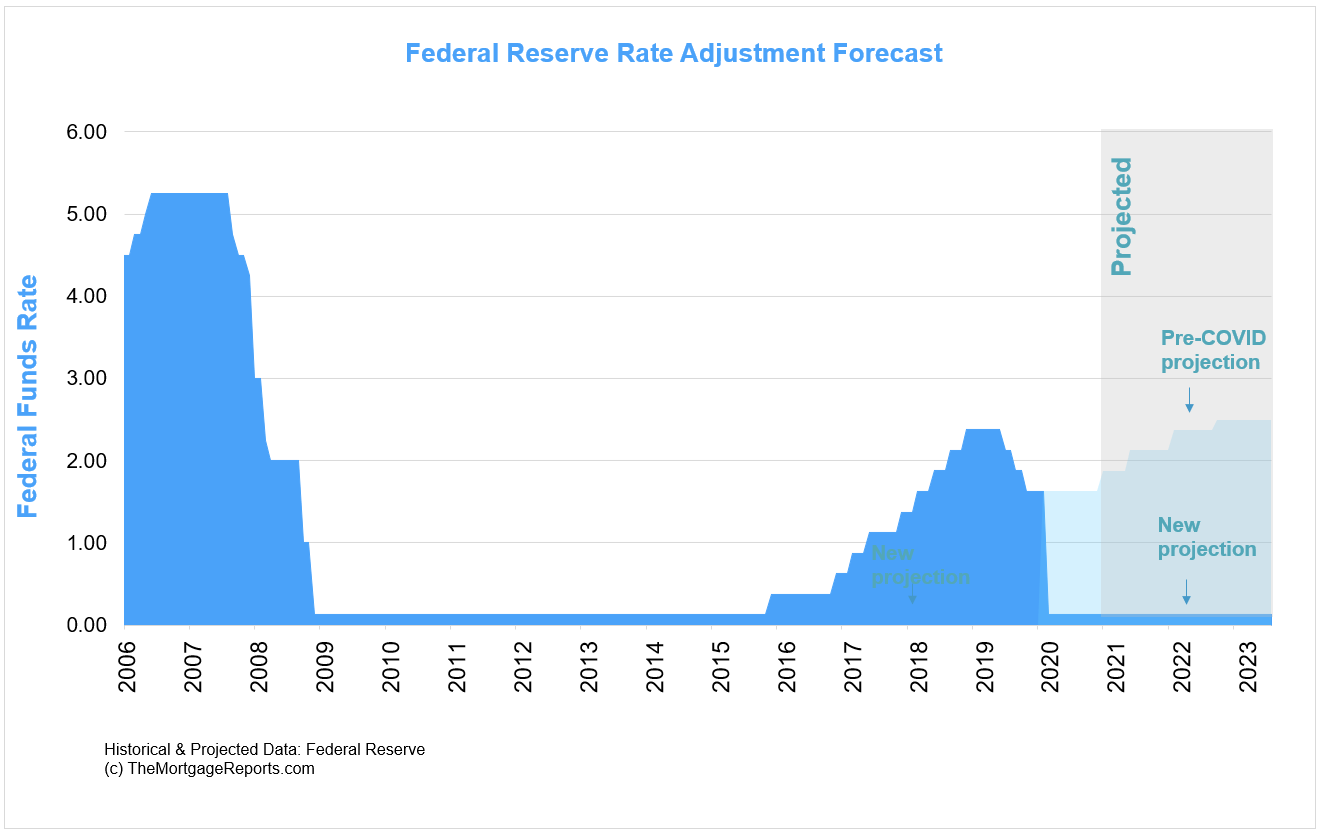

The Fed to maintain its benchmark price low till 2023

The Federal Reserve has a couple of levers with which to maintain charges low within the financial system.

Mentioned above is bond purchases which have the most important impression on mortgage charges.

However an oblique methodology of price suppression is to maintain its benchmark price — the federal funds price — close to zero.

This price degree permits banks to borrow cash at practically no value — which has a trickle-down impact on client borrowing and rates of interest typically.

The Fed’s present rate-friendly stance is a boon for mortgage customers.

What does this imply for the private funds of the typical

American client?

It means you’ll seemingly have entry to ultra-low charges for years. Maybe not as little as they’re now, however very low from a historic standpoint.

In the event you’re prepared, it’s a incredible time to lock in.

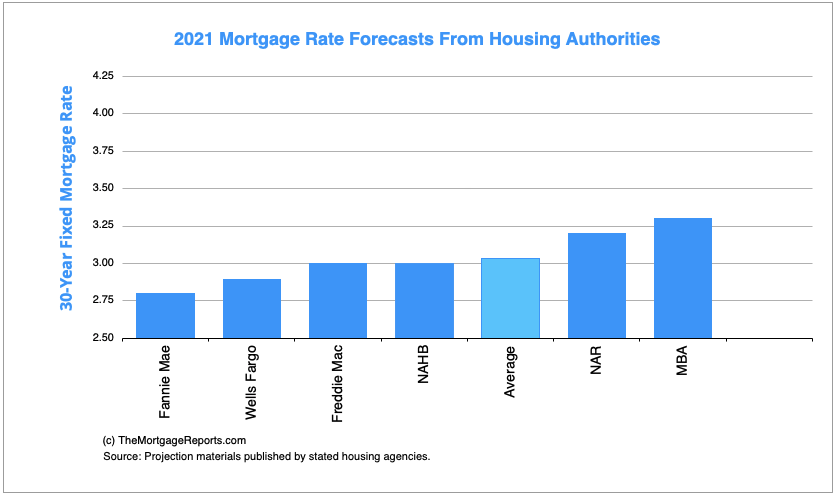

Mortgage price developments as predicted by housing authorities

Housing companies nationwide are calling for charges within the excessive 2s and low 3s for 2021.

| Company | 30-Yr Fee Prediction |

| Fannie Mae | 2.80% |

| Wells Fargo | 2.89% |

| Freddie Mac | 3.00% |

| Nationwide Assoc. of House Builders | 3.00% |

| Nationwide Assoc. of Realtors | 3.20% |

| Mortgage Bankers Assoc. | 3.30% |

| Common of all companies | 3.03% |

To sum it up, price predictions differ broadly. At this time’s price is perhaps pretty much as good as we’ll see for years to come back, or they may enhance.

Mortgage methods for March 2021

Listed here are the developments of most significance that we see for dwelling consumers and householders this month.

March 2021 will maintain the right alternative to cancel mortgage insurance coverage

House values skyrocketed in 2020. As 2021 progresses, householders will benefit from the twin blessing of rising dwelling values and low charges.

This places them in a incredible place to refinance out of mortgage insurance coverage.

Most dwelling consumers don’t put down 20%. The typical is extra like 6%. However meaning most first-time dwelling consumers are paying some sort of mortgage insurance coverage.

Mortgage insurance is not bad, however it’s not enjoyable to pay, both.

Fortunately, many householders now have 20% fairness regardless of making solely a 5-10% down cost not that way back.

These householders can refinance into a traditional mortgage and get rid of mortgage insurance altogether.

That is true for these with non-public mortgage insurance coverage (PMI) or FHA mortgage insurance coverage (MIP).

It may prevent a whole bunch of {dollars} per 30 days.

If your property fairness has skyrocketed within the final 12-24 months, it’s value speaking to a lender, who can let you realize your possibilities of refinancing out of your mortgage insurance coverage for good.

Faucet into dwelling fairness (properly) whereas charges are low

Many householders are sitting on an enormous battle chest of dwelling fairness.

The humorous factor is, few are tapping into it, even at rock-bottom charges.

In some methods that is good. Within the mid-2000s, we noticed rampant borrowing in opposition to actual property and other people cashing out houses each few months. This led to catastrophe.

However as we speak’s home-owner appears overly subdued in the case of properly utilizing dwelling fairness.

Within the third quarter of 2020 (the newest knowledge out there), simply 34% of householders took out a 5% increased mortgage stability when refinancing. Examine that to 89% in Q3 of 2006, in accordance with Freddie Mac.

Regardless of the ailing popularity of the ‘cash-out refinance,’ it’s really a really great tool if used appropriately.

Many individuals with a 22% rate of interest on a big bank card stability may pay it off with a 3% cash-out refinance.

Likewise, auto loans, pupil loans and different pesky debt might be consolidated into one low month-to-month cost.

Remember that most mortgages final 30 years, so you find yourself paying these money owed longer. But when your major purpose is to cut back month-to-month bills, a cash-out refinance may work wonders.

Money-out refinance for dwelling enchancment

However consolidating debt isn’t the one purpose to make use of a cash-out refinance.

Throughout COVID, many corporations transitioned staff to everlasting work-from-home. This sounds nice till you notice your property wasn’t arrange for it.

One answer: take a cash-out refinance so as to add on sq. footage, convert a part of the storage to workplace area, or convert a room to a house workplace.

House additions might be cost-prohibitive, at a median of $48,000 in accordance with homeguide.com. You in all probability don’t have that sort of money mendacity round.

However this quantity is definitely very attainable for a lot of householders through a cash-out refinance.

You sometimes should preserve at the least 20% fairness within the dwelling after the refinance (and higher charges can be found should you depart 25% fairness). So usually, a cash-out refinance is perhaps value it should you presently have about 35-40% fairness and your property is value round $250,000 or extra.

A cash-out refinance can provide the almost-instant money to enhance the house, thereby making it extra livable throughout these occasions whereas including substantial worth.

Get started on your loan application here. (Feb 18th, 2021)

Mortgage product price updates

Many mortgage customers don’t notice there are lots of various kinds of charges in as we speak’s mortgage market.

However this information may help dwelling consumers and refinancing households discover the most effective worth for his or her state of affairs.

Following are updates for particular mortgage varieties and their corresponding charges.

Standard mortgage charges

Conventional refinance rates and people for dwelling purchases trended decrease in 2020, and are nonetheless ultra-low in 2021.

In accordance with mortgage software program firm Ellie Mae, the 30-year mortgage price averaged 2.91% in January (the newest knowledge out there), down from 2.93% in December.

That is increased than Freddie Mac’s 2.81% weekly common as a result of it elements in low credit score and low-down-payment typical mortgage closings, which have a tendency to come back with increased charges.

Plus, it’s a extra delayed report, and rates of interest

have been dropping.

Decrease credit score rating debtors can use typical loans, however these loans are extra suited to these with respectable credit score and at the least 3 % down.

5 % down is preferable attributable to increased charges that include decrease down funds.

Twenty % of fairness is

most popular when refinancing.

With satisfactory fairness within the dwelling,

a traditional refinance can repay any

mortgage kind. Bought an Alt-A, subprime, or high-PMI mortgage? A conventional refi can

handle it.

As an example, say you bought a

dwelling three years in the past with an FHA loan at 3.5 % down.

Since then, dwelling costs have skyrocketed.

Due to your increased dwelling worth, you

now have 20 % fairness, which implies you can

refinance into a traditional mortgage and eliminate FHA mortgage insurance.

This might be a financial savings of

a whole bunch of {dollars} per 30 days, even when your rate of interest goes up.

Eliminating mortgage insurance coverage

is an enormous deal in any mortgage market. This mortgage calculator with PMI

estimates your present mortgage insurance coverage value. Enter a 20 % down

cost to see your new cost with out PMI.

Find a low conventional loan rate. Start here. (Feb 18th, 2021)

FHA mortgage charges

FHA is presently the go-to program for dwelling consumers who might not qualify for typical loans.

The excellent news is that you’ll get an identical price — and even decrease — with an FHA mortgage mortgage than you’d with a traditional one.

Associated: Learn extra about FHA prices and

necessities on our FHA loan

calculator page.

In accordance with Ellie Mae, which processes greater than 3 million loans per 12 months, FHA mortgage charges averaged 2.86% in January, a bit decrease than the typical typical price.

One other attention-grabbing stat from

Ellie Mae: About 20 % of all FHA loans are issued to

candidates with credit score scores beneath 650.

FHA loans include mortgage

insurance coverage. However the total value will not be rather more than for typical loans.

A little bit-known program, known as the

FHA

streamline refinance, helps you to convert your present

FHA mortgage into a brand new one at a decrease price if charges are actually decrease.

An FHA streamline mortgage utility requires

no W2s, pay stubs, or tax returns. And also you don’t want an appraisal, so dwelling

worth doesn’t matter.

Find low FHA rates. Start here. (Feb 18th, 2021)

VA mortgage charges

Owners with a VA mortgage presently are eligible for the ever-popular VA streamline refinance.

No revenue, asset, or appraisal documentation is required.

In the event you’ve skilled a lack of revenue or diminished financial savings, a VA streamline can get you right into a decrease price and higher monetary state of affairs. That is true even whenever you wouldn’t qualify for the standard refinance.

However don’t overlook the VA loan

for home buying. It requires zero down cost.

Which means when you have the money for closing prices, or

can get them paid for by the vendor, you should purchase a house with out elevating any

further funds.

Don’t overlook the VA mortgage for dwelling shopping for. It requires zero down cost.

VA mortgages are supplied by native and nationwide lenders, not by the federal government immediately. Most active-duty members or veterans of the USA army can qualify.

This public-private partnership presents shoppers the most effective of each worlds: robust authorities backing and the comfort and velocity of a non-public firm.

Most lenders will settle for credit score scores all the way down to 620, and even decrease. Plus, you don’t pay excessive rates of interest for low scores.

Fairly the opposite, VA loans include the bottom charges of all mortgage varieties in accordance with Ellie Mae.

In January, (the newest knowledge out there), 30-year VA mortgage charges averaged simply 2.60% whereas typical loans averaged 2.91%, representing an enormous low cost should you’re a veteran.

Test your month-to-month cost with this VA loan calculator.

There’s unbelievable worth in VA loans.

Check today’s VA loan rates. Start here. (Feb 18th, 2021)

USDA mortgage charges

Like FHA and VA, present USDA mortgage holders can refinance through a “streamlined” course of.

With the USDA streamline refinance, you

don’t want a brand new appraisal. You don’t even should qualify utilizing your present

revenue. The lender will solely just remember to are nonetheless inside USDA revenue

limits.

House consumers are

additionally studying the advantages of the USDA loan program for home buying.

No

down cost is required, and charges are ultra-low.

House funds might be even decrease

than hire funds, as this USDA loan calculator

reveals.

Qualification is less complicated as a result of

the federal government desires to spur homeownership in rural areas. House consumers would possibly

qualify even when they’ve been turned down for one more mortgage kind prior to now.

Like FHA and VA loans, the USDA program is for individuals who

wish to purchase or refinance a main residence; these mortgage packages aren’t for

actual property builders.

Find a lock low USDA rates. (Feb 18th, 2021)

Mortgage charges as we speak

Whereas monitoring month-to-month mortgage price forecasts and weekly averages are useful, it’s vital to know that charges change day by day.

You would possibly get 3.00% as we speak, and three.125% tomorrow. Many elements alter the course of present mortgage charges.

To get a synopsis of what’s taking place as we speak, go to our daily rate update. You will see that reside charges and lock suggestions.

March financial calendar

The following 30 days maintain no scarcity of market-moving information. Basically, information that factors to a strengthening financial system may imply increased charges, whereas unhealthy information from economists could make charges drop.

- Friday, March 5: Nonfarm Payrolls, wages, unemployment price

- Wednesday, March 10: Inflation price

- Tuesday, March 16: NAHB Housing Market Index

- Wednesday, March 17: Fed funds price, FOMC announcement

- Wednesday, March 17: Housing Begins, Constructing Permits

- Monday, March 22: Present House Gross sales

- Friday, March 26: Private Earnings, Private Spending

- Wednesday, March 31: Pending House Gross sales

Now might be the time to lock in a price in case these occasions push up charges this month.

Mortgage charges Q&A

Beneath are a number of the commonest questions on mortgage charges.

Mortgage charges fluctuate based mostly on market circumstances and your particular state of affairs. As an example, somebody with a excessive credit score rating will get a decrease price than somebody with a low rating.

In accordance with our survey of main housing authorities resembling Fannie Mae, Freddie Mac, and the Mortgage Bankers Affiliation, the 30-year mounted price mortgage will common round 3.03% by means of 2021. Charges are hovering beneath this degree as of February 2021.

Sure. Lenders have the flexibleness to drop their charges and costs. Usually, you should strategy a lender with a greater provide in writing earlier than they may decrease their price.

Traditionally, it’s a incredible mortgage price. However, charges are presently hovering decrease than this for well-qualified candidates. The typical price since 1971 is greater than 8% for a 30-year mounted mortgage. To see if 3.875% is an effective price proper now and for you, get 3-4 mortgage quotes and see what different lenders provide. Charges differ drastically based mostly available on the market and your profile (credit score rating, down cost, and extra).

Most corporations have comparable charges. Nonetheless, some provide ultra-low charges to realize market share. Others have decrease charges for FHA than typical, or vice versa. The one technique to know if your organization is providing the bottom price is to get quotes from numerous lenders.

A degree is a price equal to 1 % of your mortgage quantity, or $1,000 for each $100,000 borrowed. Your rate of interest may drop 1 / 4 to a half a proportion level or extra for every level paid. Nonetheless, that may differ relying on the lender, mortgage traits, and borrower profile.

You may 1) request a lender credit score; 2) request a vendor credit score (if shopping for a house); 3) improve your mortgage price to keep away from factors; 4) get a down cost reward (which can be utilized for closing prices); 5) get down cost help.

Treasury yields and mortgage charges should not immediately linked, however they’re strongly correlated. 10-year Treasury yields and 30-year mounted mortgage rates of interest have a tendency to maneuver in lock step with each other. That’s as a result of each merchandise are purchased on the secondary market by the identical sorts of buyers.

Mortgage charges are increased than Treasury yields as a result of mortgages are inherently extra dangerous. Rates of interest for mortgages are based mostly on costs for mortgage-backed securities (MBS). The identical elements that drive MBS up or down normally drive Treasuries up or down, therefore the frequent false impression that Treasuries drive mortgage charges.

The Fed doesn’t set mortgage charges, however its financial insurance policies affect mortgage markets. In occasions of financial uncertainty, the Fed promotes decrease rates of interest to encourage extra borrowing which helps stimulate the financial system. Decrease charges can even elevate dwelling values which bolsters many Individuals’ internet value.

In the event you entered into mortgage forbearance due to the coronavirus pandemic, you could possibly qualify for a refinance after exiting your forbearance plan. In the event you missed funds throughout forbearance, you’ll should make three consecutive on-time funds earlier than qualifying for a traditional refinance, in accordance with FHFA’s guidelines.

What are as we speak’s mortgage charges?

Low mortgage charges are nonetheless out there. You may get a price quote inside minutes with only a few easy steps to start out.

Show Me Today’s Rates (Feb 18th, 2021)

Chosen sources:

- https://www.elliemae.com/mortgage-data/origination-insight-reports

- https://tradingeconomics.com/united-states/calendar

- https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

- http://www.freddiemac.com/analysis/datasets/refinance-stats/index.web page

[ad_2]

Source link